Loan App Accessibility For Modern Financial Needs

Managing finances has become more flexible with the growth of digital services. A loan app now plays an important role in helping individuals handle urgent and planned expenses without lengthy procedures. Many people prefer to get loan online because it reduces paperwork, saves time, and allows access to funds from anywhere. An easy loan app makes borrowing more practical by offering simple steps, clear terms, and faster processing, which aligns well with modern financial requirements.

As daily expenses, medical needs, education costs, and household responsibilities continue to increase, digital loan solutions have become a reliable option for many users. This explains how loan app accessibility supports financial needs while maintaining clarity, safety, and convenience.

Understanding Loan App Accessibility

What Makes a Loan App Accessible

Accessibility in a loan app means that users can apply, track, and manage loans without confusion or technical barriers. A well-designed platform allows individuals from different backgrounds to understand the process easily. Simple navigation, clear instructions, and readable layouts improve the overall experience.

A loan app becomes more effective when it supports multiple devices and works smoothly even with basic internet connectivity. This helps users from both urban and semi-urban areas benefit equally.

Importance of Digital Lending Access

Digital access ensures that financial services reach users who may not always visit physical locations. A loan app enables people to apply at their convenience, reducing dependency on traditional processes. This accessibility also promotes better financial planning, as users can compare options and understand repayment responsibilities clearly.

How Loan Apps Support Modern Financial Needs

Quick Access to Emergency Funds

Unexpected expenses can arise at any time. A loan app helps users respond to such situations by allowing them to get loan online without delays. The application process usually involves basic information submission, making it easier to access funds when time is critical.

Flexible Use for Different Requirements

Loan apps are designed to support various personal needs such as education, household improvements, or short-term financial gaps. The flexibility to choose loan amounts and repayment durations makes borrowing more manageable.

Key Features That Improve Loan App Usability

Simple Application Process

A clear and straightforward application process reduces user stress. An easy loan app avoids unnecessary steps and focuses on essential details only. This approach allows users to complete applications confidently.

Transparent Loan Information

Transparency builds trust. Loan apps that clearly explain interest rates, repayment schedules, and charges help users make informed decisions. Easy-to-understand information prevents confusion during repayment.

Secure Digital Environment

Security is a major concern for online users. A reliable loan app uses secure systems to protect personal and financial information. This ensures users feel safe while applying and managing loans digitally.

Step-by-Step Guide to Using a Loan App

Step 1: Account Setup

Users begin by creating an account using basic personal details. This step ensures identity verification while keeping the process simple.

Step 2: Loan Selection

After registration, users can select a suitable loan amount and tenure based on their needs and repayment capacity.

Step 3: Application Review

Once details are submitted, the loan app reviews the application. This stage is usually quick and does not require physical documentation.

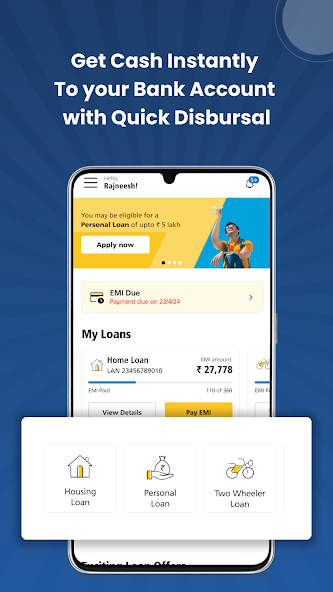

Step 4: Loan Management

After approval, users can track repayment schedules and balances directly through the app interface.

Benefits of Using Loan Apps Over Traditional Methods

Time Efficiency

Traditional loan processes often require multiple visits and long waiting periods. A loan app reduces this by allowing users to complete everything digitally.

Reduced Documentation

Minimal documentation simplifies the borrowing process. Users can submit required details online without handling physical paperwork.

Better Financial Control

Loan apps offer dashboards that help users monitor repayments and due dates. This supports better budgeting and financial discipline.

Responsible Borrowing Through Loan Apps

Understanding Repayment Obligations

Before applying, users should review repayment terms carefully. A loan app makes this information available upfront, helping users plan responsibly.

Avoiding Over-Borrowing

Borrow only what is necessary. Easy access should not lead to unnecessary debt. Loan apps support responsible usage by clearly displaying repayment commitments.

Common Challenges and How Loan Apps Address Them

Digital Literacy Concerns

Some users may be unfamiliar with online platforms. A well-structured loan app uses simple language and guided steps to support first-time users.

Connectivity Limitations

Many loan apps are optimized to work efficiently even with moderate internet speeds, improving accessibility across regions.

Future of Loan App Accessibility

As digital finance evolves, loan apps are expected to become more user-focused. Improved interfaces, better support systems, and clearer information will further enhance accessibility. These improvements will help more users get loan online confidently while maintaining financial awareness.

Conclusion

A loan app has become an essential financial tool for individuals seeking convenience and clarity. The ability to get loans online reduces stress and allows users to manage expenses efficiently. An easy loan app supports modern financial needs by offering accessible features, transparent information, and secure processes. By understanding how these platforms work and using them responsibly, users can benefit from digital lending while maintaining financial balance.

As financial habits continue to shift toward digital solutions, loan app accessibility will remain a key factor in supporting everyday financial decisions.